If you’ve noticed that your credit file contains records of bad debt, such as judgments or missed payments, you may be wondering how to clear your file and improve your overall credit. It’s important to know that credit agencies like TransUnion keep a register of major financial transactions and support the lenders in assessing your creditworthiness. Therefore, if your credit file displays negative entries, it’s essential to take action.

When it comes to bad debt, the first step is to review your credit report and determine whether it accurately reflects your financial situation. Look for any mistakes or inaccuracies that could be damaging your credit score. If you find any, you should contact the credit reporting agencies and explain the situation. They have a statutory obligation to investigate and remove incorrect information from your file.

If your credit report does contain accurate negative entries, there are several steps you can take to remove them. First, contact the creditor or collection agency associated with the debt and discuss your options. They may be willing to negotiate a payment plan or settle the debt in exchange for removing the negative entry from your file. It’s important to get any agreements in writing and to keep detailed records of all communications.

If the creditor or agency does not cooperate, you may need to explore alternative options. One option is to seek help from a credit repair agency. These organizations specialize in working with creditors and credit bureaus to improve your credit. They can help you dispute negative entries and negotiate settlements on your behalf.

In some cases, you may need to take legal action to remove bad debt from your credit file. If a debt has been discharged in bankruptcy or if there are court judgments that should have been removed, you may need to file a motion with the court to have these entries wiped from your file.

It’s important to note that removing negative entries from your credit file takes time and effort. While there are no guarantees, following these steps and staying on top of your finances can help you improve your credit over time. It’s also important to continue making timely payments on any existing accounts and to avoid defaulting on any new obligations. By taking proactive steps to clean up your credit file, you can improve your financial standing and increase your chances of obtaining credit in the future.

Important Note: It’s crucial to be patient and persistent when dealing with bad debt and credit agencies. Remember, building a clean credit history takes time, but the effort will be worth it in the long run.

- Understanding the Importance of Credit Score Repair

- Why Request Negative Adjustments?

- How to Request Negative Adjustments

- Working with Credit Reporting Agencies

- Importance of an Accurate Credit Report

- Goodwill and Removing Negative Debt Markers

- Conclusion

- The Process of Reviewing Your Credit Report

- Identifying Errors on Your Credit Report

- Steps for Identifying Errors on Your Credit Report:

- Disputing Inaccurate Information on Your Credit Report

- 1. Review Your Credit Report Carefully

- 2. Gather Evidence to Support Your Claim

- 3. Dispute the Inaccurate Information

- 4. Contact the Creditor or Reporting Party

- 5. Follow Up and Track Progress

- Writing a Letter to the Credit Bureau

- Step 1: Review Your Credit File

- Step 2: Craft Your Letter

- Step 3: Sending the Letter

- Step 4: Follow-Up and Ombudsman

- Monitoring the Removal of Bad Debt

- 1. Keep Track of Your Accounts

- 2. Check with Credit Reporting Agencies

- 3. Review Your Updated Credit Report

- 4. Follow Up with Creditors

- 5. Seek Legal Assistance if Needed

- 6. Be Patient and Persistent

- Following Up with the Credit Bureau

- 1. Get a copy of your credit file

- 2. Look for any notice of adjustment

- 3. Contact the credit bureau

- 4. Follow the credit bureau’s instructions

- 5. Consider alternative options

- 6. Keep a record of all communication

- Video:

- HOW I REMOVED 7 COLLECTIONS FROM MY CREDIT REPORT *YOU DON’T HAVE TO PAY*

Understanding the Importance of Credit Score Repair

Your credit score plays a critical role in your financial life. It determines your ability to secure loans, obtain favorable interest rates, and even affects your eligibility for certain jobs. Therefore, it is essential to maintain a good credit score and take steps to repair it if it has been negatively impacted. One way to improve your credit score is by requesting negative adjustments to be made on your credit file.

Why Request Negative Adjustments?

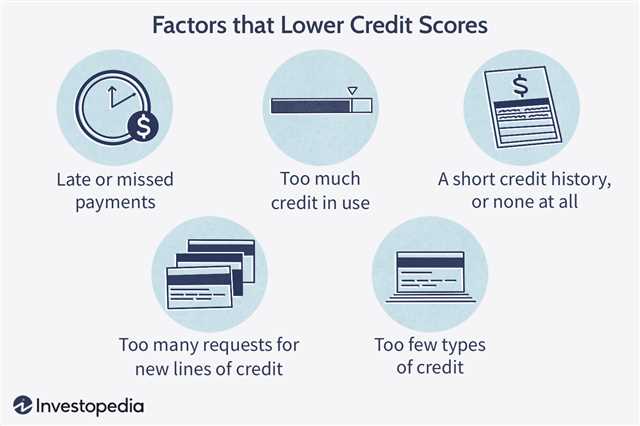

When negative entries appear on your credit report, they can severely impact your credit score. These entries can include missed payments, delinquent accounts, and even court judgments. By requesting negative adjustments, you can remove or amend these items, helping to clean up your credit report. This will improve your credit score and increase your chances of obtaining credit in the future.

How to Request Negative Adjustments

Here’s a step-by-step guide on how to request negative adjustments:

- Obtain a copy of your credit report from a credit reporting agency such as TransUnion. Review the report to identify any inaccurate or negative entries.

- Identify the specific items you would like to dispute or have adjusted. Make note of what information is inaccurate or missing.

- Research the laws and regulations related to credit reporting in your country. Understand what rights you have and how you can take action to dispute negative entries.

- Contact the credit reporting agency and explain your situation. Provide them with the necessary documentation to support your claim for negative adjustment.

- Follow up on your request and be persistent. Keep detailed records of all communication and any responses that you receive.

- If necessary, escalate the issue to higher authorities or seek legal support to handle the matter.

Working with Credit Reporting Agencies

When dealing with credit reporting agencies, it’s important to be in control of the situation. Contact them directly and politely explain your request for negative adjustment. Provide any documentation or evidence that supports your claim, such as payment receipts or court documents. Keep in mind that credit reporting agencies are regulated and must follow certain rules and guidelines when handling credit files.

Importance of an Accurate Credit Report

An accurate credit report is vital for your financial well-being. It allows lenders, employers, and other entities to assess your creditworthiness and make informed decisions based on your credit history. By taking the necessary steps to remove negative entries from your credit file, you can ensure that your credit report reflects your true financial standing.

Goodwill and Removing Negative Debt Markers

If you have delinquent accounts or negative debt markers on your credit report, it is advisable to contact the lenders or service providers directly. Explain your situation and express your willingness to repay the debt. Many lenders offer goodwill services that allow them to remove negative markers from your credit report, provided you make a repayment plan or settle the debt. Contacting lenders and negotiating directly can be a more effective approach than relying solely on credit reporting agencies.

Conclusion

Repairing your credit score is a crucial step towards financial stability. By understanding the importance of credit score repair and taking action to request negative adjustments on your credit file, you can improve your creditworthiness and secure better opportunities in the future. Remember to stay diligent and proactive in managing your credit history, and seek professional assistance if needed.

The Process of Reviewing Your Credit Report

Reviewing your credit report is an important step in removing bad debt from your credit file. By thoroughly examining your credit report, you can identify any negative items or inaccuracies that may be affecting your credit score. Here is a step-by-step guide to help you through the process:

- Obtain a copy of your credit report: You can request a free copy of your credit report from one of the major credit bureaus, such as TransUnion, Experian, or Equifax. Each bureau may have slightly different information, so it’s a good idea to obtain reports from all three.

- Go through your credit report: Carefully examine each entry on your credit report. Look for any defaults, delinquent accounts, judgements, or other negative marks that may be impacting your credit score. Take note of which items you wish to address and remove.

- Understand the factors contributing to your credit situation: Learn about the different factors that can affect your credit score, such as late payments, high credit utilization, or collections. Understanding the causes of your bad debt will help you plan for the necessary changes.

- Determine which items can be legally removed: Some negative items, such as late payments or collections, can be removed from your credit report if certain conditions are met. Research your country’s laws to find out what can be legally removed, and consider seeking professional advice if needed.

- Consider alternative options: If it’s not possible to legally remove certain items from your credit report, there are alternative options you can pursue. For example, you can contact the creditor and try to negotiate a payment plan or request a “goodwill” adjustment.

- Request removal or amendment: For the items that can be legally removed or amended, contact the credit bureau and follow their instructions for submitting a request. Provide any necessary documentation to support your claim, and be prepared to provide evidence that the information is inaccurate or unfair.

- Monitor your credit report: After submitting your request, keep an eye on your credit report to ensure that the negative entries are being removed or amended. It may take some time for the changes to take effect, so be patient.

- Repay your debts: While working on removing bad debt from your credit file, it’s important to address the underlying issue by repaying your debts. This will help improve your credit score in the long run.

By following this process, you can take steps to remove or amend negative entries on your credit report and improve your credit situation. Remember to stay informed about the laws and guidelines regarding credit reporting in your country, and don’t hesitate to seek professional help if needed.

Identifying Errors on Your Credit Report

One of the first steps in removing bad debt from your credit file is to identify any errors that may be present on your credit report. Your credit report is a document that shows a summary of your credit history and is used by lenders to determine your creditworthiness.

To find errors on your credit report, you can request a free copy of your report from credit reference agencies like TransUnion, Equifax, or Experian. These agencies will show any items that may be damaging your credit score, such as missed payments, defaults, or judgements.

When reviewing your credit report, make note of any inaccurate information or errors that you find. Some common errors include incorrect personal details, such as your name or address, or entries for loans or credit cards that do not belong to you. It is important to ensure that the information on your credit report is accurate and up to date, as lenders rely on this information when deciding whether to lend to you.

Steps for Identifying Errors on Your Credit Report:

- Request a copy of your credit report from one of the credit reference agencies.

- Review the report and look for any inaccuracies or errors. Pay attention to personal details, loan or credit card entries, and negative items like missed payments or defaults.

- If you find any errors, make a note of them. Take note of any supporting evidence you may have, such as payment receipts or loan agreements.

- Contact the credit reference agency to inform them about the errors and provide the necessary evidence to support your claim. You can do this by sending a written letter or using their online dispute form.

- The credit reference agency will investigate your claim and work with the relevant lenders to correct any errors. This process may take some time, so it is important to monitor your credit report regularly to ensure that the corrections have been made.

- If the credit reference agency does not take action or you are not satisfied with their response, you can escalate the issue to the Financial Ombudsman Service (FOS) in the UK. The FOS can help resolve disputes between consumers and financial companies.

Keep in mind that removing negative items from your credit report can improve your credit score and make it easier for you to obtain loans or credit cards in the future. However, it is also important to note that some negative items, like missed payments or defaults, may stay on your credit report for a certain period of time, as dictated by the statute of limitations.

In conclusion, identifying errors on your credit report is an essential step in removing bad debt from your credit file. By reviewing your report carefully and taking the necessary steps to correct any inaccuracies, you can improve your overall creditworthiness and increase your chances of being approved for credit by lenders.

Disputing Inaccurate Information on Your Credit Report

If you find inaccurate information on your credit report, it’s essential to take steps to dispute and remove it. Here’s a step-by-step guide on how to do it effectively:

1. Review Your Credit Report Carefully

- Obtain a copy of your credit report from each of the major credit bureaus, namely Equifax, Experian, and TransUnion.

- Thoroughly examine the report to identify any errors or inaccuracies in your personal information, accounts, payment history, or negative entries.

2. Gather Evidence to Support Your Claim

- Collect any relevant documents, such as payment receipts, bank statements, or correspondence, that can prove the inaccurate information on your credit report.

- Be sure to make copies of these documents before submitting them as evidence.

3. Dispute the Inaccurate Information

- Write a formal dispute letter to the credit bureau that issued the inaccurate report.

- Clearly state the inaccurate information, explain why it is incorrect, and provide the supporting evidence you gathered.

- Mail the dispute letter via certified mail to ensure it reaches the credit bureau and to maintain a record of your communication.

4. Contact the Creditor or Reporting Party

- If the credit bureau fails to remove the inaccurate information, contact the creditor or reporting party directly.

- Explain the situation, provide the same evidence as before, and request that they correct the information they provided to the credit bureau.

- You may need to escalate the matter to a supervisor or manager to have a better chance of reaching a resolution.

5. Follow Up and Track Progress

- Keep copies of all correspondence and any responses received from the credit bureau, creditor, or reporting party.

- Monitor your credit report regularly to ensure that the inaccuracies have been removed or corrected.

- If the errors persist or the negative information is not removed, consider seeking legal assistance or contacting a credit repair service for further guidance and support.

Remember, removing inaccurate information from your credit report may take time and patience. However, taking the necessary steps can potentially improve your credit score and overall financial standing in the long run.

Writing a Letter to the Credit Bureau

If you have identified any errors or inaccuracies in your credit file that are negatively affecting your credit score, it is important to take action by writing a letter to the credit bureau. This step-by-step guide will walk you through the process of drafting a letter to TransUnion, one of the major credit reporting agencies in the UK, to request the removal of bad debt from your credit file.

Step 1: Review Your Credit File

Before writing your letter, it is essential to review your credit file thoroughly. Look for any mistakes, missing information, or inaccuracies that could be negatively impacting your credit history and credit score. Take note of these issues and gather any supporting documents that can evidence your claims.

Step 2: Craft Your Letter

Begin your letter by introducing yourself and providing your personal details, including your full name, address, and credit file number if available. Explain the purpose of your letter, which is to request that TransUnion amends your credit file by removing the specific negative information that you have identified.

In the body of the letter, give a detailed account of the mistakes or errors you have found in your credit file. Clearly state the reasons why these negative markers should be removed, such as incorrect information, outdated records, or court judgments that have been discharged or paid in full. Provide any relevant evidence or documentation to support your claims.

It is essential to remain polite and professional throughout your letter. Avoid using offensive or accusing language, as this may hinder the effectiveness of your request.

Step 3: Sending the Letter

Once you have completed drafting your letter, make sure to proofread it for any spelling or grammatical mistakes. Ensure that all the necessary information is included and that your arguments are clear and well-supported.

Print the letter and send it to TransUnion via certified mail with a return receipt. This will provide you with proof of delivery, which is crucial in case any disputes arise. Keep a copy of the letter for your records.

Step 4: Follow-Up and Ombudsman

After sending the letter, give the credit bureau some time to investigate and respond to your request. Usually, they have 28 days to resolve the issue or provide a satisfactory response.

If TransUnion does not respond within this timeline or does not address the issues as you had hoped, you can escalate the matter by contacting the Financial Ombudsman Service. The ombudsman can assist you in resolving any disputes between yourself and the credit reporting agency.

Remember, removing bad debt from your credit file is not guaranteed, and the process can take time. However, taking the initiative to address these issues and rectify any mistakes is an essential step towards improving your credit history and financial well-being.

Monitoring the Removal of Bad Debt

Once you have taken the necessary steps to remove bad debt from your credit file, it is important to monitor the progress and ensure that the damaging items are actually being removed. Here are some steps you could follow:

1. Keep Track of Your Accounts

Make a list of all the accounts that you requested to be removed from your credit file. This will help you check if those accounts have been successfully removed.

2. Check with Credit Reporting Agencies

Contact the credit reporting agencies (such as TransUnion, Equifax, and Experian) to verify if the negative items have been removed from your credit file. They can provide you with an updated credit report.

3. Review Your Updated Credit Report

Carefully go through the updated credit report provided by the credit reporting agencies. Make sure that all the damaging items have been removed and no accounts are missing.

4. Follow Up with Creditors

If you find that some negative items are still present on your credit report even after requesting their removal, contact the respective creditors and remind them of your previous request. Provide them with any necessary documentation to support your case.

5. Seek Legal Assistance if Needed

If the creditors refuse to remove the damaging items from your credit file, you may need to seek legal assistance. A lawyer specializing in credit and finance can help you deal with this situation and guide you on what steps to take next.

6. Be Patient and Persistent

Removing bad debt from your credit file may take some time. It is important to be patient and persistent in your efforts. Follow up regularly with the credit reporting agencies and creditors to ensure that the damaging items are removed.

Remember, repairing your credit takes time and effort, but it is achievable. By monitoring the removal of bad debt and taking the necessary steps, you can improve your credit score and overall financial well-being.

Following Up with the Credit Bureau

Once you have taken the necessary steps to request the removal of bad debt from your credit file, it is important to follow up with the credit bureau to ensure that they have taken the appropriate action. Here are some steps you can take to stay on top of the situation:

1. Get a copy of your credit file

Before following up, it is important to obtain a copy of your credit file. This will allow you to see if the negative entry has been removed or if any mistakes have been corrected. There are several credit bureaus in the UK that you can contact to get a copy of your credit file.

2. Look for any notice of adjustment

When reviewing your credit file, look for any notice of adjustment or removal of the negative entry. This will indicate that the credit bureau has taken action to remove the bad debt from your file.

3. Contact the credit bureau

If you do not see any notice of adjustment, or if the negative entry is still present on your credit file, contact the credit bureau to inquire about the status of your request. Be sure to have documentation of your original request and any supporting evidence that you provided.

4. Follow the credit bureau’s instructions

The credit bureau may provide you with further instructions on how to proceed. Follow their instructions carefully and provide any additional information or documentation that they request.

5. Consider alternative options

If the credit bureau does not remove the bad debt from your credit file or if you are not satisfied with their response, you may want to consider alternative options. One option is to contact the Financial Ombudsman Service, which can help resolve disputes between consumers and financial institutions.

6. Keep a record of all communication

Throughout the process of following up with the credit bureau, be sure to keep a record of all communication, including dates, times, and the names of the individuals you spoke with. This will be useful if you need to escalate your complaint or provide evidence in the future.

By following up with the credit bureau and staying proactive about the removal of bad debt from your credit file, you can improve your overall credit score and financial situation.